Aphria is 1 of 21 licensed producers authorized under the Marihuana for Medical Purposes (MMPR) that is able to both cultivate & sell cannabis in Canada. The firm has ~42,000 square feet of greenhouse cultivation space situated in Leamington, Ontario. Aphria is traded on the TSX Venture Exchange under the ticker symbol APH.V and also trades in the United States in the OTC Markets under the ticker symbol APHQF; APHQF is a security that tracks the price of APH.V adjusted for currency differences in the Canadian Dollar vs. US Dollar.

On 3/10/16 Aphria preannounced their 3rd quarter earnings for the period ended 2/29/16.

Aphria’s revenue increased 32% quarter over quarter, while at the same time costs declined 11% from the previous quarter. Aphria added 600 patients from the previous quarter, representing a quarter over quarter increase of 17.65%. While the patient count increase is impressive, Aphria’s CEO Vic Neufeld said in a recent interview they couldn’t add more patients due to high demand for a period of time as they expanded their greenhouse capacity, which was completed recently. Aphria plans in the not to distant future to enter Phase 2 of their expansion plans by increasing their greenhouse capacity by adding another 88,000 square feet making their future total capacity of ~130,000 square feet; the cost of the expansion is expected to be $4 million which they can fund through their sizable cash position and internal cash flow. Of all publicly traded companies and potentially all LPs in Canada, Aphria is the lowest cost producer due to their geographical location in Leamington, Ontario, commonly known as the ‘Tomato Capital of Canada.’ In Q2, Aphria became the 1st LP to be cash flow positive and in this quarter they are expecting EBITDA margins of 18% – 20%.

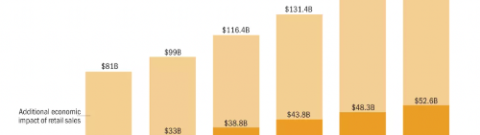

While Phyto Partners is bullish on Canopy Growth Corporation, Phyto Partners sees more near term (12 – 18 months) potential in Aphria as investors have not discovered how undervalued this company truly is. Aphria has a market cap of ~$75 million with $15 million of cash and $0 debt; Enterprise Value of $60 million. Management owns 42.4% of the shares outstanding making the company’s tradable float tiny. In comparison to other LPs that are publicly traded, Aphria has the best growth profile and valuation metrics. For 2016, the average publicly traded Canadian LP trades at 21.8X EV/EBITDA, while Aphria trades at 9.1X EV/EBITDA. Looking at 2017, Aphria trades at 4.6X EV/EBITDA in comparison to analysts’ estimates of 6.0X EV/EBITDA for publicly traded LPs. While Canopy Growth Corp may deserve the premium multiple (2016 EV/EBITDA of 41.5X and 2017 EV/EBITDA of 11X), Aphria has a very similar growth profile + profitability making this stock scratch my head as the stock trades as a discount to other LPs with lower growth rates, no profitability for at least a few quarters, and pressure for some of the producers to seek out equity/debt financing.

At Phyto Partners we are bullish on the Canadian cannabis market as the medical market seems to be growing voraciously and with the hopes of a recreational market launching in the next year or so. Our top picks for the Canadian cannabis market are Aphria and Canopy Growth Corporation. While we are very bullish on Canopy Growth Corp, we think Aphria is deeply undervalued and will outperform Canopy Growth Corp over the next 12 months. In the long run, Phyto Partners thinks Canopy Growth Corp is positioning itself to be a global brand and is making the necessary investments forgoing immediate profitability to dominate the global cannabis market. Investors looking to allocate capital in this industry should look at APHQF and TWMJF as they are positioned to dominate the Canadian market and abroad.