I have been involved in the cannabis industry for about 5 years. I got involved way before it was cool, and frankly before it was OK to admit that you were doing Cannabis professionally. When I would tell people I am investing in the Cannabis industry, the response was always awkwardly positive and interested, but confused at how I could be doing this. Most people would say to me “thats going to be a big industry and I wish I could get involved, BUT…” and then the plethora of reasons why they couldn’t, wouldn’t or shouldn’t be invested in or even tacitly associated with anything that had to do with Marijuana, “because its still federally illegal.”

Fast forward, to today and I am asked about the industry everyday and everyone wants to know “how can I get in.” The mainstream financials news has embraced the Marijuana investment mania and has elevated the status of the CEO’s and industry pioneers as they would any other emerging market or technology.

The recent frenetic activity surrounding cannabis related business news including US Cannabis companies getting listed in Canada, NYSE IPO’s of Canadian Cannabis companies, medical breakthroughs, capital creation events, has definitely caught the attention of many, most of which wouldn’t even consider investing in the Cannabis industry just last year.

The list of wall street names joining the Cannabis party continues to grow. Karan Wadhera, MD Goldman Sachs, Leon Cooperman, famed hedge fund manager, Chris Leavy, former BlackRock Executive, Danny Moses, FrontPoint Partners Housing crash fame, Derek Peterson, former Morgan Stanley Executive, and the list is growing daily.

As I watched CNBC interview the Tilray CEO after their first quarterly report as a publicly traded NYSE stock, not one time did the interview host use a marijuana pun or double entendre, and the scroll at the bottom of the screen referred to Tilray as a “Cannabis company” not a pot stock or weed grower.

I know that may seem unimportant, but in fact its a HUGE change in propaganda, messaging and for how the public and investors will view the industry going forward and the companies involved.

This coupled with the overt involvement of Bank of America Merrill Lynch and Goldman Sachs in the widely discussed $4bil deal with Constellation Brands and Canopy Growth. And while their is still a perceived and in some cases actual banking problem for some Cannabis related businesses, at some point others will most certainly join the party OR accept losing out on participating in what may become the largest capital creation and NEW industry birth since the tech boom of the 1990’s.

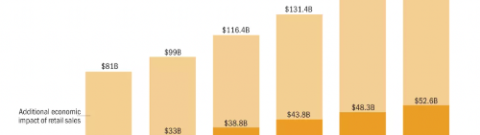

The Cannabis industry has only just begun a ramp up capital formation, I think the entire market cap of ALL the pot stocks and Canadian LP’s is like . Bitcoin industry is now something like $300-400bil up from literally zero in 2012, and Bitcoin doesn’t generate ANY revenue at all. The Cannabis industry will not only generate annual revenues of $100bil worldwide, the capital pouring into the industry now will be used to build out the infrastructure of the industry which will be the engine to do that.

Cannabis, much like the internet, is not a single industry, or product…it is a platform and an ecosystem. Cannabis is a natural resource that can be used in thousands of consumer products ranging from pharmaceuticals to fitness drinks, mood changing elixirs to medications for sleep, beauty products to bottled water. Cannabis will DISRUPT and change any number of industry’s from Healthcare to Sports, Restaurants to Resorts.

Now that the capital markets are paying attention something has definitely changed and it will propel the industry to it’s next level of growth and development.