Cannabis is a commodity, and just like every other agricultural commodity, the volatility will be intense as the market finds its equilibrium price. The problem is that instead of cannabis being a global commodity, it has different prices at the state level, in different legal markets. Because the growing environment may be more suitable to grow outdoors in California, the wholesale price of cannabis can be cheaper there than it is in Colorado that has primarily indoor grows. The state-by-state cannabis system is creating artificial prices in different states and not letting the national/world market determine the optimal price of cannabis. Since our federal government has not recognized cannabis as a medicine, the U.S.’s cannabis industry is trailing many other countries. By not recognizing cannabis at the federal level, this has enabled states to start their own cannabis programs. With 4 recreational states, along with 24 medical states, it has been a great start to the eventual legalization at the federal level. However, as each day passes by, other countries are surpassing the United States in their cannabis programs. A few countries have already decided to legalize cannabis for medical purposes including: Israel, Canada, Australia, and Germany. Some countries such as Canada and Uruguay are even looking to legalize the plant at the federal level and treat it like alcohol. By these countries setting up a legal framework, this enables businesses in those jurisdictions to surpass the U.S. in terms of R&D and a host of other competitive areas.

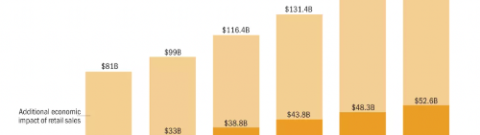

Colorado did $996 million in total sales for cannabis in 2015 and had a total of ~2,500 cannabis businesses (dispensaries, cultivators, and MIPs). Colorado has more dispensaries than Subways, 7-Elevens, and Starbucks! That’s a lot of businesses operating in a single state and that number is expected to go up. Unfortunately, as the market increases, the pricing will fall and there most likely will be too much product on the market, causing a sharp decline in price. What could make matters worse is the fact that you cannot ship cannabis across state lines. This means that companies operating in a state have to lay out all the CAPEX to open a location in a different state or do a licensing deal. This causes companies who wish to scale across state lines an enormous headache to be able to service the entire cannabis market. If Native Roots or LivWell wanted to enter the Washington market, they would obviously have to build a retail location but they would also have to build a grow facility because they aren’t allowed to ship product from their Colorado grow to another state. This would mean that Native Roots would have to spend a lot of money restarting their business in a new state with different regulations.

Although Canada is not as big as the United States in terms of the cannabis industry, the Canadian market is still valuable with an expected market size of $7 – $10 billion annually. In a market that size, there are currently 31 licenses in Canada to produce product. To put things in perspective, everyone in the cannabis industry is excited for California’s bill this year to legalize recreational access to cannabis. While that will be a watershed moment in this country if the initiative is approved, the California market is expected to $6.6 billion by 2020. That makes California a smaller market than Canada AND a much more competitive market with 1,000s of cannabis businesses already in place and more on the way post-legalization. Countries like Canada that have created an oligopoly market that enables each individual producer in Canada to be a sizable facility so they can supply the entire Canadian market. There are multiple grows in Canada that are in excess of 300,000 square feet that are capable of producing 30,000 kilograms+ of cannabis annually. With the ability to plop down and build a facility that can service a $7 – $10 billion industry, you are seeing a lot of strategic locations by the licenses as they compete on having the lowest production costs. Some licenses in Canada have gone the traditional farming route and set up greenhouses in great greenhouse conditions like Leamington, ‘Tomato Capital of Canada,’ others set up shop in large warehouse facilities in jurisdictions with deregulated electricity to have the lowest electrical bills, etc…

The point that is being made is that cannabis businesses that are able to service an entire country will look to find the best growing environment in the country to grow the best product at a low cost. Unfortunately in the United States, some states that have cannabis legislation in place that are in geographies not conducive to growing cannabis well. States like Alaska and Colorado are not optimal states to grow cannabis from a national standpoint. Because the market is limited by the state, cannabis companies compete to find competitive advantages within the state to operate in. Due to Colorado and Alaska’s lengthy winter seasons, growing outside is limited, so production is nearly all-indoor in Colorado. This is an artificial market that is allowing companies in state programs to compete in fair battle on the state level but if and when this goes federal, there will be many states that could have a massive decline in cultivators as multinational corporations look for outdoor conditions that are the most cost effective and conducive to grow certain strains. And the only reason Cannabis would ever be grown indoors is because its illegal so the cultivation could not be outside in the open, it had to be hidden. When that changes, the rationale and cost for indoor growing diminishes greatly.

Another reason indoor growing could have significant downward pressure is because some cannabis strains originated in places that are paralleled to any growing condition. Just like wine, coffee, cigars, and people like certain wines from various countries because they produce a distinct product that can’t be replicated in any other climate. Similarly with fruit, Florida is known for their oranges, Georgia is known for their peaches, and Hawaii for pineapples. Something about these geographical locations are ideal for these crops. Cannabis will become that way as connoisseurs will want product from places/countries that have unrivaled growing conditions for certain strains. In order to get the best Hindu Kush and Afghan Kush it may be grown outside in the Middle East region and other places can try to grow those strains but it won’t have the true terpenoids and cannabinoid profile of the outdoor strains. In addition to growing in those countries, in a fully legal worldwide market, a company could buy massive amounts of parcels of farmland in indigenous areas for certain strains, grow outside in those favorable conditions, and then ship/distribute the product around the world; It’s no different than the United States sourcing avocados from Mexico.

The viability of the indoor grow market with its high relative costs to greenhouses and sun grown product stands to be challenged if and when laws change. Being that cannabis is still a high valued crop it can continue to be grown indoors, which has fostered an agricultural technology boom to try and lower costs. Because of the surge in the cannabis industry and the push to make agriculture sustainable for our growing population and declining arable land, there has been a massive push to develop technology that can make indoor growing cost competitive with outdoor growing. Comparing outdoor growing vs. indoor growing on pros/cons is another article in itself but the key takeaway is that low production costs are necessary to survive the future glut of cannabis production. The agricultural technology boom is taking place and these entities are trying to solve problems from being able to have a grow room change it’s climate to a specific outdoor growing condition to creating lights that accurately mimic the sun through LED light spectrums. As these companies power cultivators to utilize their indoor space efficiently, this enables for the multitude of benefits of indoor growing to really shine (vertical farming, more grow cycles, less pest management, standardized product, etc).

While outdoor growing will always be a threat to indoor growers, the agricultural technology industry is emerging to close the gap and is making it economical to grow indoors. As a society, if we are able to make indoor growing economical to outdoor growing, our world will be completely better situated to combat the global food production problem for our growing population. We are in the infancy of ‘agtech’ and if we are able to mimic indoor environments in grow rooms, you could theoretically grow in Hindu Kush or ‘Florida Oranges’ inside a grow room in North Dakota. This enables food to be grown locally which stimulates the economy and ensure consumers are eating food that was grown locally and standardized.

At Phyto Partners, we consider all investment opportunities in the cannabis space but are also looking at agricultural technology companies that can leverage their services in the cannabis industry.