Welcome to “The GreenWave Buzz”, a periodic briefing intended to provide insights and analysis of various subject matters and business trends effecting the emerging cannabis industry. In this issue, we revisit our initial industry thesis and expectations from 2014, assess where we are today, and look ahead to where we think the industry is going.

A LITTLE MORE COUNTRY, BUT GETTING READY TO ROCK AND ROLL

The continuing trend of individual state approvals of cannabis use along with the recent end of prohibition in Canada have sparked a heightened level of interest in the U.S. Cannabis industry among a larger and more sophisticated pool of investors. This interest has been further inspired by the U.S. Federal Government’s continued reluctance to aggressively interfere with individual state permissions despite early on threats by the Trump Administration’s Department of Justice led by the recently dismissed Attorney General Jeff Sessions. We continue to believe that the rescission of federal cannabis prohibitions is inevitable, the question is when. Given the confluence of reform measures at both the state and federal levels we are optimistic that a first step for meaningful change to federal policy could come as early as next year with the passage of The STATES Act (a bipartisan bill providing state protections under the Tenth Amendment).

The complexity of the U.S. cannabis industry has been exacerbated by the consequences of states operating within the confines of closed economies that strive for their own interpretations of legitimacy under the shadow of existing federal laws. This variation of standards from one state to another carries an inherent uncertainty for businesses and investors with respect to how the industry will operate subsequent to the delisting or reclassification of cannabis as legal standards evolve.

We have in the past promoted a bullish stance as to the prospects of the cannabis industry’s potential development. Beginning with our first publication, “The GreenWave Report: State of the Emerging Marijuana Industry – Current Trends and Projections” (October, 2014) we suggested five primary underpinnings we believed would sustain development and growth moving forward towards national legalization. Since then, we have observed a steadfast progression on all fronts:

“Compelling economic benefits that are derived from the creation of new jobs and tax revenues”. Since 2014, we conservatively estimate the cannabis industry has created ~100K jobs in the U.S. From 2014 through the end of this year, we estimate total sales tax revenues (medical and recreational) will have totaled $3.5 Billion (excluding tax collections from wholesale and manufacturing).

“The U.S. Department of Justice planted the seeds for reform by allowing each state to determine and enforce its own marijuana laws under a set of mandated guidelines established by the Obama Administration (“Cole Memo”)”. While the federal government has continued to maintain the prohibitive legal status of marijuana, the pressures brought to bear by the multitude of state and multinational statutes that have locally decriminalized and regulated its use have steadily comforted business development within the industry. Post this year’s elections, there are 33 states (plus D.C.) that allow medical marijuana (up from 24 (plus D.C.) at the end of 2014) and 11 states (plus D.C.) where cannabis is fully legal (up from 4 (plus D.C.) at the end of 2014). Additionally, we expect legislative measures allowing recreational use to soon pass in several other states (including New Jersey and New York).

“Shifting opinions and demographics have led to bipartisan support”. Americans in favor of legalization has increased from 58% in 2013 to 68% in 2017 (Gallup Poll). We note 89% of cannabis related bills introduced in the current Congressional Session are bipartisan supported (at least one Republican Co-sponsored) and out of this count, 44% are Co-sponsored with a majority of Republicans. This is a notable difference from legislation introduced in prior sessions (61% and 22% respectively).

“The Federal Drug Administration (FDA) signals a willingness to understand the medicinal benefits of Cannabis”. Epidiolex was recently approved by the FDA as a treatment for young children that experience severe seizures from epilepsy. Subsequent to the FDA approval, the U.S. Drug Enforcement Agency placed this drug in Schedule V (least restrictive classification). This medication is now commercially available and as we understand, covered by most insurance plans. The FDA approval is significant because it marks the beginning of an inevitable inflection point that will recalibrate and redefine medical marijuana (as it exists today) with precise dosage and efficacy.

“The federal government has stepped up spending for marijuana research”. Production requirements for medical marijuana research has increased steadily from ~1,400 pounds in 2014 (up from just 46 in 2003) to ~5,400 pounds earmarked for 2019. Additionally, the federal program has extended eligibility to other participants besides the University of Mississippi which has historically been the sole source of all cannabis research. We believe that the government’s willingness to make substantial further investment in marijuana related research suggests a higher probability that a change to the current Schedule 1 classification will occur sooner than we had originally anticipated.

EXPECTATIONS FOR THE NEXT PHASE OF INDUSTRY GROWTH

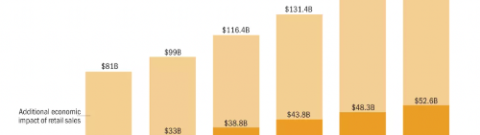

We remain bullish on the overall prospects of the cannabis industry and this year’s election results in which 3 states passed reform measures (MI – Recreational Use, MO, UT – Medical), supports our trajectory for its growth potential before federal prohibition ends. Since 2014, we have taken the non- consensus view that every state will permit medical marijuana or fully legalize its use before the end of federal prohibition. Accordingly, we maintain our estimate that the U.S. retail cannabis market could reach ~ $35B by 2022 up from ~ $9.6B in 2018 with much of its growth attributed to newly established markets (fully legal or medical only in all remaining states).

Along the way, we expect the following:

A green wave of consolidation: Subsequent to the initial euphorias of “limitless entrepreneurial potential” fostered by individual state cannabis permissions, unforeseen pitfalls and consequences (such as ill- defined rules and regulations, delays in state license issuances, lack of funding etc.) have taken a toll on many first actor enterprises. These unforeseen consequences of the incremental advancement of legalization from one state to the next has in many ways defined this early phase of development. We predict that some of these new realities will become the cornerstones of a mature cannabis industry.

In our 2014 report, we suggested that “larger players in cultivation will have the ability to accommodate mass market production with higher profit margins due to economies of scale, and smaller competitors will likely need to consolidate for survival”. The headwind of IRS Section 280E (disallows most operating expenses for tax purposes), pressures most of these plant touching enterprises from achieving positive free cash flow. Today we witness increased competition within maturing state markets and as standards become more defined and federally mandated and regulated (under agencies such as the FDA and Department of Agriculture) an economy of scale will be a priority for sustainability and growth particularly as new and sizeable entrants emerge ready and able to compete aggressively (Big Pharma, Big Alcohol etc).

Maturation of existing markets following the Colorado Peak: We expect Colorado to report flat to negative revenue growth this year which establishes a benchmark of 5 years to maturity (Jan ’14 – Dec ’18). However, the trajectory of growth in any one state may not be congruent with other markets as the velocity of falling wholesale prices is not consistent within each state. Additionally, Colorado may be an outlier because it benefited from “canna” tourism in the early years as the only state to allow cannabis consumption for recreational use. As we continue to evaluate the fundamentals of other fully legal states (Oregon and Washington) we observe that these markets, while not fully mature, have slowed.

Product quality and reliability will likely differentiate business profiles: Within the cannabis ecosystem businesses will establish and endeavor to maintain more specific niche identities. Whether individual enterprises seek to penetrate the market from the lower or upper end of perceived consumer demands, successful market penetration will be heavily dependent upon the allocation of increased branding efforts.

Following federal legalization there will be a “true” divergence of medical and recreation use enterprises: Although medical use legislations were the first to burst the prohibition dam, the development of true medical applications has been slow to develop. Subsequently, many recreational users have previously gained access to cannabis products through quite general qualifying medical conditions (such as chronic pain). As new states implement recreational use, we believe that many of these “patients” have become “consumers” evidenced by the decline in cardholder counts.

While we do not intend to understate the importance or necessity of medical marijuana as an alternative treatment for many debilitating health conditions, there presently appears to be little distinction between the various designated medicinal use products and those offered in a recreational market. We reiterate our belief that the medical marijuana market will in time, be recalibrated when the pipeline of new, more targeted medicaments become available and as the medical profession gains more comfort in “pushing” a cannabis treatment rather than a patient having to “pull” a recommendation.

Further to this is our expectation that states with both legalized medical and recreational use will continue to evaluate the practicality of merged regulatory regimes. Our research suggests that the medical community’s participation has been insignificant, as ~5% of licensed physicians in existing medical marijuana states are registered to recommend marijuana to qualified patients thus inhibiting the full potential of a medical market. Hence, we believe that it will be increasingly more difficult for medical marijuana sales to thrive in a dual market environment (particularly as our findings suggest that average monthly dispensary revenues are near half that of recreational retail outlets). It is logical to assume that regulatory oversight and enforcement will be less redundant, more cost efficient, and less confusing in a merged platform. For all intent and purposes, we see this effort presently in most of the states that allow recreational use. (See our report, “The State of Colorado- Year One: The Co-Existence of Legalized Medical and Recreational Use Marijuana Markets” March, 2015).

Banking Reform on the Horizon: The implementation of California’s recreational use market in January continues to raise public safety concerns due to the magnitude of cash collections (we estimate ~ $3.5B in 2018 including sales tax). Unlike sales consummated through the black market, the legal retail channels contain an added element of risk – a known address where a cash transaction occurs (i.e. dispensary). California failed to pass legislation this year that would have created a state backed bank to serve its cannabis businesses. The U.S. market is heavily concentrated in California (~ 40%) and as such we think Congress will soon take action to ease federal restrictions.

With the advent of federal acceptance, cannabis businesses across the board will have access to traditional banking services. This normalized financial environment will enable businesses to not only execute point of sale transactions in a safe and secured manner, but will also enable access to competitive short and longer term financing options.

(See our report, “Navigating the Shoals of Cannabis Banking Regulations” (November, 2017) for more on this subject matter).

The CBD market and ancillary businesses provide compelling investment opportunities. The proliferation and diversity of the various state legalized marijuana markets have spawned numerous and different ancillary enterprises that are eagerly seeking a permanent foothold in the evolving cannabis eco-system. Lab testing, Seed-to-Sale Software and Delivery Services are particularly appealing to us. Also, we believe the CBD market has promise for tremendous growth which will likely ignite soon after the Hemp Farm Bill is passed. We will provide further discussions around these topics in a subsequent edition of “The GreenWave Buzz”.

Republished with permission from GreenWave Advisors . http://www.greenwaveadvisors.com/