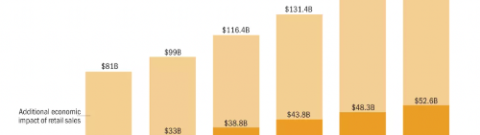

In 2014, 68 companies raised $97.1 million in the cannabis industry. In 2015, that number grew to $215.2 million in 98 cannabis related businesses. During that time, cannabis consultanting companies have emerged to help entrepreneurs access capital and strategic business planning services (contacts, financial monitoring, etc). As those consultants entered the industry, many young companies become strapped with the burden of these additional consulting costs.

In 2014, 68 companies raised $97.1 million in the cannabis industry. In 2015, that number grew to $215.2 million in 98 cannabis related businesses. During that time, cannabis consultanting companies have emerged to help entrepreneurs access capital and strategic business planning services (contacts, financial monitoring, etc). As those consultants entered the industry, many young companies become strapped with the burden of these additional consulting costs.

These consulting firms may offer a small investment in exchange for a monthly consulting agreement or make a small investment in exchange for a large percentage stake in exchange for their consulting services. These agreements cause 2 major problems. First, if a company offers a small investment for a monthly consulting agreement, this increases the burn of a young company that needs to retain all their raised capital to execute their business plan. If someone offers a low amount of capital for a large percentage of the business this causes the cap table to become crowded and further rounds are hard to complete as there is less equity to provide to incoming shareholders. The common theme in those 2 investment scenarios are that they hamper the company from achieving their primary objective of growing their business.

It is important for start-ups to makes the best choices to enable them to reach their maximum potential. The key takeaway from this blog is that all companies should know that all investment dollars isn’t good money. If someone offers a company a consulting agreement or excess equity for a small investment, that company must ensure the agreement is fair. While investors must do their due diligence on a prospective investment, companies need to do due diligence on prospective investors.