Brands win the battle. It’s not the “picks and shovels” that win, however that’s not a bad spot to be in during a gold rush. We have lived there for the last 5 years earning healthy returns, taking lower risk by avoiding directly touching the plant. With the de-scheduling of CBD in September 2018, and large investments from alcohol companies this year, it’s time to take the gold and turn it into Rolex watches and penetrate the US market with branded cannabis and CBD wellness products. The Canadian market and many markets in the US are poised for over- supply of cannabis. As extraction techniques continue to become more refined, the quality of the cannabis becomes less important, the technology behind the extraction and delivery becomes more important.

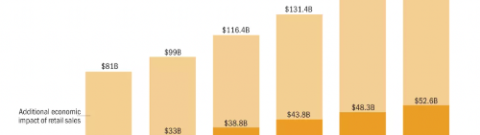

Value added cannabis products, which consists of anything that is created from dried marijuana: like oils, beverages, vape pens, capsules, brownies, candies, beverages, etc have seen tremendous growth over the last several years in legal markets. Dried flower has declined from 70% share of retail cannabis sales in Q1/2014 to only 47% by Q4/2017 (BDS Analytics). This is a huge market shift to see in a 3 year time period, and we believe as new users get introduced to the market, it will continue to shift toward value add products.

We think the largest demographic of the future cannabis market are people who have not used cannabis before, who are quite different from the individuals that smoke bong rips of cannabis. We intend to go after this market and target our efforts through investments in value added product brands that market themselves as a lifestyle brand and deliver on expectations of a certain mood by strategically adding terpenes. We do not want a brand to be limited to either the CBD wellness market or the THC mind altering market. We believe in both markets and see participation in CBD only as a way to operate with less business risk prior to federal legalization in the US.

The next generation of experimenting users will most likely not suffer from eating the whole batch of cannabis brownies and then going to the emergency room. However, that was a common story of past generations due to inaccurate dosing, etc. Companies have learned and got better at dosing edibles and more importantly, are now working on formulating new ways to speed up the delivery time and reduce the effect time. This is important because cannabis’s natural digestive rate is roughly 1-2 hours depending on the person. To create a product that will compete with alcohol, it needs to be for the instant gratification consumer – it needs to be fast acting.

There are now products, that do not make the user stoned, but rather relaxed and uplifted, that are perfect for the day off at the beach or at the park with your kids. Products that give functioning individuals the opportunity to be in the moment more and more often through targeted micro doses of cannabinoids.

We believe delivery of the cannabinoids, promised effect, and of course taste are super important criteria for deciding between a product on the edible market. With tailwinds to the ingestibles market as a whole, we wish to pursue companies that are focused on the growing sub segments within it, such as beverages and candy

Because of the tailwinds specifically in value added products, we do not see the need to own/operate any fixed around production of dry flower, as we believe more and more of the commoditization of dry flower, and the expansion of value added products

*(Genetics and superior production/cost structure will be a differentiator, growing cannabis is just not our expertise and we have developed those relationships and have an investment in a genetics company; Grownetics).

We want to be within the last mile for the consumer.