Guest post by Eric Lasky

Each new transformational era reminds us of missed opportunities. I was there when cable TV was born and was lucky to have a Motorola StarTac so soon after Captain Kirk wielded his on Star Trek. How do I explain to my children what a 9600 modem was or what life was like before Google? Opportunity, Invest, Gold rush, Fortune, Next. Rinse and Repeat. Like it or not, Cannabis is the current alternative investment nirvana. Medical scientists have already made billions. Think of pioneering GW Pharmaceuticals Inc. With its $44 billion market cap. Fortunes were made and cannabis was still illegal. Financial gurus and a community of cannabis pioneers currently maintain billions in market capitalization and ‘High Times’ isn’t even public yet. Some believe cannabis is the future of medicine. Pharmaceuticals have always had bottomless pockets, so it was no surprise that they were the pioneers of the cannabis sector. Medicine is full of deep unknowns. Even family offices with high-end medical consultants on staff could not have been entirely to blame. It was a scary first step.

Opinions are plentiful and quality opportunities are limited in number primarily due to the illegality at the federal level. Governor Cuomo recently set in motion plans to make recreational use in New York legal. Which is more attractive for state governments, the reduction in correctional facility expenditures or the additional tax revenue for underfunded education programs? We expect that, but we’re continually opening our eyes to the verticals. How can one commodity that grows like a weed has so many opportunities? It’s almost not fair.

In October 2017 Constellation Brands, a beverage company invested $191 million in a Canadian cannabis company. That investment gave Constellation Brands their own personal window into the cannabis economy. That guaranteed them the opportunity to look down the rabbit hole and see what was there. Ten short months later, Constellation Brands invested another $4 billion in that same company. We can assume they saw Nirvana. After the pharmaceutical industry success, although it was ok to be still skeptical. It was less the case the day after Constellation Brands made its first investment, but was it still ok to question if there was another

opportunity after the next round?

When we learned about prohibition, as investors, what we told ourselves should have pertinence here. What would we have invested in or better yet, what would we have wished we had invested in?

Even after pharmaceutical companies succeeded with cannabis, logic would have directed you to cigarettes and logic would have been wrong…but not for long.

Four months after Constellation Brands became $4 billion serious, on December 7th, 2018, Altria Group plunked down $1.8 billion into Cronos Goup, Inc. for a minority stake in Canada’s fourth largest Canadian Cannabis producer.

Any family office that is not invested in cannabis is not paying attention to the math and is missing a tremendous opportunity. Please proceed to the nearest ostrich farm. The largest consumer products companies in the world are tripping over each other to align themselves with the Cannabis Economy. Some say we’re in the first inning and no company or investor should miss this.

The transactions we’ve highlighted here are a pittance compared to what’s to come. M&A activity has started percolating. Multiple countries are plotting their own game plans and are not waiting for cannabis legalization at the federal level, but they all believe it’s coming.

Ask Larry Schnurmacher, Managing Partner of Phyto Partners. Phyto Partners is his Marijuana Investment Fund which is rated in the Top 5 by Forbes Magazine. His venture capital fund invests in privately held companies operating in the cannabis industry. In many of Phyto’s investments, they avoid much of the legal downside by investing in lateral cannabis industry businesses such as software. A comparison can be made to the gold rush era and those who sold pickaxes and shovels to the gold miners. “The cannabis economy will continue to grow exponentially without regard or correlation to the economy, interest rates, or other asset classes,” he added.

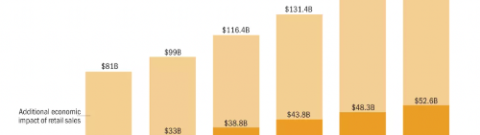

If you meet up with Larry at his daily yoga practice, he will open your eyes to the valuable data that is currently being mined on the habits of cannabis users. Weeks ago, Larry returned from The Marijuana Business Conference & Expo in Las Vegas and the evidence is overwhelming. “Attendance is like in the first days of Comic-Con, Namaste.” Attendance at the annual MJBizCon brought 25,000 attendees and 1,000 exhibitors, a roughly 50% increase since 2017. Every insider we’ve spoken to says the same thing. It’s Econ 101: The market and demand already exist. The TAM (Total Addressable Market) continues to grow and expand both geographically and demographically.

Four days after Altria bought into The Cronos Group, a Federal Farm Bill compromise was reached, which is expected to provide subsidies to farmers. This is bullish for hemp and cotton should heed the warning. Hemp is three times stronger than cotton; Naturally resistant to mould and mildew; Softens with each washing, without fibre degradation; Breathable; readily takes dyes and it grows like a weed. You will assuredly read more about this when High Times, the cannabis industry’s longstanding magazine, becomes publicly traded in the near future.

Recently a think tank suggested that the taxes on marijuana could pay

for much-needed subway repairs. Separately, a New York University

group estimated that an annual $1 billion in taxes would end up in state coffers.

Reliable surveys estimate that marijuana approval statistics have

exceeded 60 per cent and most agree that these numbers will increase when cars drive themselves. The danger of driving under the influence of cannabis will be nonexistent when self-driving Uber’s and Tesla’s control of the wheel without human interference.