Company Description

Aphria (APH.v) is a vertically integrated Canadian medical marijuana company that is 1 of the 22 Licensed Producers (LP) legally allowed to cultivate and sell cannabis under Health Canada’s Marihuana for Medical Purposes Regulations (MMPR). They are based out of Leamington, Ontario, which is often referred to as the ‘Tomato Capital of the Canada’ because it has one of the longest growing seasons and has the largest concentration of greenhouses in Canada. Aphria was founded in 2014 and got their license to cultivate and sell cannabis from Health Canada in November of 2014 and began shipping medicinal cannabis in January 2015.

Market Opportunity

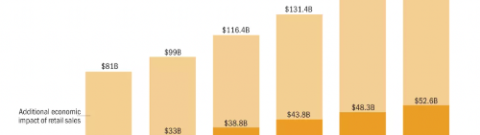

By 2024, Health Canada projects that the medical cannabis market in Canada will reach $1.3 billion and have ~450,000 patients. The Canadian medical cannabis market last reported patient count was 43,342 for the month ending January 2016; up from 16,682 from January 2015, which translates into patient growth of 159.81% year over year. The market today is estimated to be ~$200 million and growing substantially quarter over quarter as depicted in the picture below.

The patient growth is being fueled by a multitude of factors including: doctors are more willing to prescribe cannabis, the stigma is fading, and medical research is validating cannabis’ medicinal properties.

In order to legally cultivate and sell cannabis in Canada, each company must be granted a license from Health Canada under the MMPR. As of now, there are 31 companies that are licensed under the MMPR. Of those 31, only 22 are licensed to cultivate and sell cannabis to medical patients nationwide. Of those 22 licenses to cultivate and sell, some companies own multiple licenses so the total number of companies licensed to cultivate and sell cannabis in Canada is actually 18. The government has been slow to issue new licenses so the market for cannabis businesses is relatively small compared to the United States.

For comparative purposes, in Colorado, there are ~2,500 licensed cannabis businesses and the qualifications of opening up a business in Colorado are miniscule. The Colorado market is estimated to do $1.1 billion worth of sales this year compared to $996 million in 2015.

So you have a market that has many players competing in a $1.1 billion industry, while Canada has a much more restrictive market and has 31 licenses competing in a $1.3 billion market. Also, that $1.3 billion figure only represents the medical market in Canada, the recreational market is expected to be worth $7 – $10 billion. On April 20th 2016, the Canadian Health Minister Jane Philpott announced that Canada would introduce legislation to decriminalize and regulate cannabis in spring of 2017.

In the upcoming November election, California will also be voting on permitting recreational cannabis access. “If California legalizes adult use in 2016 as expected and adult use sales become operational in 2018, the state market is expected to reach nearly $6.6 billion by 2020,” said Giadha DeCarcer, Founder and CEO of New Frontier. While U.S. investors are in a frenzy to capitalize off of the enormous California cannabis market, Canada is a larger market with less competition. Unlike Canada, U.S. firms are unable to ship cannabis across the country, so if a business wants to expand into another state it must either do a licensing deal or build a facility in the legal state it chooses to enter. This makes it very difficult and costly to expand domestically, while in Canada they are able to have massive grow facilities that can service the entire country.

Share Structure

Aphria has 64,984,290 shares outstanding. The fully diluted share count is 92,626,775; 56% of their warrants/options are priced above the current market price of $1.40. The CEO & founders of the company own 34% of the outstanding shares. This demonstrates how vested the management team is and the fact that their long term objectives are aligned with shareholders.

Competition

With 18 companies that have a license to cultivate and sell in Canada, the competitive landscape is even more appealing than it looks. The patient count is growing at a 10% compounded rate and is projected to be close to 70,000 by the end of May. In a recent article, Carl Merton, Aphria’s CFO said they expected to have 4,500 patients by the end of May. Based on those figures, Aphria has approximately 6% to 7% market share. While that doesn’t jump out as an imposing force in the industry, Aphria has been very methodical in its approach as they scaled with the growth of the industry as opposed to initially overbuilding. Now that recreational cannabis will begin in 2017, Aphria has made strategic investments to ensure they will be a market leader in the Canadian cannabis market.

Currently, there is over 1 million square feet of approved production capacity licensed in Canada. Of that ~1 million square feet of growing capacity, Aphria currently is licensed for 44,000 square feet. While that may not seem like a large chunk of square footage in comparison to the market, Aphria inked arguably the best deal in MMPR that went completely unnoticed. On April 7th 2015, Aphria “acquire[d] approximately 360,000 square feet of existing production space, located on 36 acres of land in Leamington, Ontario for total consideration of $6.5 million. As part of the agreement, Aphria acquired vacant lands that will allow it to build an additional 640,000 square feet of growing space… The Company anticipates closing the transaction on June 30, 2016. Based on current average retail selling prices and production yields, Aphria generates $580 per square foot a year.” After the closing of this deal, Aphria will have the largest production capacity available of any company in Canada.

Of the 18 companies operating in the market, there are 8 publicly traded companies:

• Aurora Cannabis (ACBFF) – 3,000 patients

• Aphria (APHQF) – 4,500 patients

• Canopy Growth Corporation (TWMJF) – 12,000 patients

• Emerald Health (TBQBF) – N/A (last reported earnings were 12/31/15 and they had $31k in revenue)

• Mettrum (MQTRF) – 6,145 patients (as of February 2016)

• Organigram (OGRMF) – ~2,000 patients*** (as of 10/21/16)

• PharmaCan (MJN.v) – N/A (Holding company that stakes in multiple Licensed Producers)

• Supreme Pharmaceuticals (SPRWF) – 0 patients*** (licensed to produce but not to sell)

Of those 8 publicly traded companies, data was available for only 5 of those companies. Those 5 companies combined for 27,645 patients, which equates to 42% of the market (27,645/65,000). Readers should also take into account that some of those patient figures provided by some of those companies are dated and that figure is higher. The point that is trying to be made is that although there are 18 companies growing and selling cannabis, 5 of those companies control 42%+ of the market. There are many private companies that have less than 1,000 patients and don’t have the financing to build out a facility that can handle any more patients. This will cause M&A to spike or many of these smaller licensed producers will not be able to survive due to the bigger company’s economy of scale in 100+ thousand square foot facilities. On June 24th 2015, the industry saw the 1st deal to consolidate when Tweed acquired Bedrocan in an all-stock transaction. News of M&A should heat up as licensed producers look to strengthen their brands ahead of the recreational market opening up next spring.

The purpose of the information above was to create an inverted pyramid of the industry and demonstrate how this already small market is smaller than many believe. Now, we’ll delve into what makes Aphria a compelling investment in comparison to the other licensed producers.

Low Cost Producer

Aphria produces a gram of cannabis for $1.67 and its “All-in” costs are $2.22 (“All-in” costs include packaging, shipping, testing, etc). Aphria is a low cost producer because they are growing in a greenhouse in Leamington, Ontario (“The Tomato Capital of Canada”) that provides a conducive environment for growing. They boast Gross Profit margins of 74% and that will only increase as they scale their 44,000 square foot facility to eventually 1 million square feet. Aphria’s low cost advantage will only strengthen as they scale because their cost structure is 42% fixed and 58% variable. With 42% of their costs fixed, Aphria will substantially reduce their COGS as the fixed costs will be spread across a larger facility and that will make them the lowest cost producer by a wide margin. Greenhouse growing is usually cheaper than indoor growing and the fact that Leamington is one of the sunniest parts of Canada allows Aphria to use natural sunlight more than any other greenhouse grower.

Strong Balance Sheet & Profitability

Aphria has one of the cleanest balance sheets, thus enabling them to finance their growth without the fear of massive dilution in excess of their fully diluted share count. This provides investors with the peace of mind that they will not be heavily diluted which could significantly hamper ROI for investors in the future. Another essential differentiating factor is the fact that Aphria was the 1st publicly traded company in the Canadian market to report a quarter of being cash flow positive. This will enable Aphria to grow their business organically through their operating cash flow and it demonstrates management’s prudent approach to building Aphria with the market as opposed to over extending itself too much.

Aphria grew revenue 32% quarter over quarter, while lowering COGS, which in turn increased Gross Margins by 500 basis points quarter over quarter. EBITDA for the 3rd quarter was $423,350, translating into a 15.8% EBITDA margin that has the potential to reach 30% – 40% as Aphria scales up production.

As of April 2016, Aphria has $14 million in cash and working capital totaling $17.7 million. Aphria has $0 in long-term debt and only $1.6 million in current liabilities. With a current ratio of 11, Aphria has a fortress balance sheet that will enable them to self-fund growth without the need to tap into the capital markets for some time. Aphria may want to go into the capital markets if they believe it is prudent to accelerate growth for the incoming recreational market but it seems unlikely with all the cash they can generate from exercising all the outstanding warrants and options. If Aphria exercised all the outstanding options/warrants it would bring in approximately $36 million. The weighted price of all the options/warrants is near the current market price, which shows management’s strong commitment to serving shareholders.

Management Team

Experience in the cannabis industry is non-existent due to the nascence of the legal cannabis market. However, Aphria has assembled an impressive management team to help navigate through this new industry. Aphria’s founders are Cole Cacciavillani and John Cervini who are agricultural veterans with over 60+ years of agricultural experience between them.

Cole Cacciavillani is an industrial engineer and son of Floyd Cacciavillani, the founder of CF Greenhouses. Cole got involved in the business in 1979 and by 1990; Cole was in charge of the day-to-day operations. CF Greenhouses was originally growing produce and eventually pivoted to grow potted flowers (germaniums, poinsettias, etc). The Cacciavillani family is very respected in the Leamington area and in 2012, CF Greenhouses turned their sights on cannabis and in 2014, they were granted a license. Cole Cacciavillani is the CEO of CF Greenhouses, which is the reason why Aphria is able to scale up quickly as they are able to replace the potted flowers for cannabis quickly as the greenhouses are already retrofitted to grow crops efficiently.

John Cervini is a 4th generation vegetable grower and chief agrologist at Aphria. Mr. Cervini, along with his brother quadrupled the family’s farming operation and founded Lakeside Produce. The company grows cucumbers, grape and cherry tomatoes, and a multitude of other vegetables sold in over 100 SKUs. Most of the product is sold in Wal-Mart’s and Costco’s in the United States.

Vic Neufeld is a Chartered Public Accountant and former partner at Ernst & Young. In 1993, Mr. Neufeld became the CEO of Jamieson Laboratories, Canada’s largest manufacturer and distributor of natural vitamins, minerals concentrated food supplements, herbs and botanical medicines. When Vic took the helm of the company, Jamieson was generating $20 million in revenue and had 7% market share. By 2014, Vic had grown the company’s sales to over $250 million and increased the firm’s market share to 27%. In January 2014, Jamieson Laboratories was sold to CCMP Capital Advisors in excess of $300 million.

Catalysts

In June 2015, the Supreme Court of Canada expanded the scope of medical cannabis by allowing cannabis to be consumed in edible products like oils, food products, etc. The ruling came in June of 2015, and since the ruling the MMPR has been licensing producers to produce and sell oils. Aphria expects to begin sales of their oil products in June of 2016, which should help drive revenue growth. Many people, especially doctors don’t want people to be smoking as a delivery method for medicine. With oils, this allows doctors to be more comfortable prescribing cannabis because oils can be dosed and administered in a safe and effective method.

With recreational cannabis coming online in spring of 2017, this will impact the entire industry, but Aphria will be one of the biggest beneficiaries. With recreational cannabis expected to be a $7 – $10 billion industry, Aphria will be able to grow nearly all of its 1 million square feet of production capacity, thus enabling them to really experience economies of scale like no other producer. Earlier in the article, Aphria mentioned that they could generate $580 of revenue per square foot of production capacity annually. As they build up their production capacity, technological and refined growing practices will allow them to generate even more money per a square foot and reduce their per gram COGS.

Current Valuation

Based upon Aphria’s 3rd Quarter revenue growth of 32% quarter over quarter, it is reasonable to assume Aphria will be able to generate at least a 30% compounded annual growth rate (CAGR) quarter over quarter as the general Canadian medical cannabis market is expected to grow at 10% compounded month over month for the foreseeable future (the market is starting from a low base so % growth will be high initially). Even though the market will grow significantly, the CAGR of the market is substantial as shown in the image below.

The medical market alone was projected to grow from 40,000 to 450,000 by 2024, representing a market CAGR of 27.38% annually.

A 30% CAGR month over month growth rate for Aphria may seem very aggressive but that is only accounting for medical cannabis sales and not even including recreational sales that will increase sales growth exponentially. Also, last quarter sales only grew 32% quarter over quarter because the company didn’t have enough in inventory to onboard more patients. With the large production increase, there will certainly not be any production bottlenecks in the future.

ASSUMPTIONS

1. 30% quarter over quarter CAGR

2. 25% EBITDA Margins

3. Using Fully Diluted Shares Count (92,646,775)

4. Only medical market (no recreational market)

5. All $ are Canadian Dollars

For the 9 months ending February 2016, Aphria had revenue of $5,657,613.

• Q1 Revenue = $950,740

• Q2 Revenue = $2,026,975

• Q3 Revenue = $2,679,898

• Projected Q4 Revenue = $3,483,867

o Projected Q4 EBITDA = $627,096

• Projected 2016 Sales = $9,141,480

o Projected 2016 EBITDA = $679,299

For the 2017 Fiscal Year, I’m projecting revenue of $28 million and EBITDA of $7 million. Based upon those assumptions Aphria would have EBITDA on a fully diluted basis of $0.08 per share; Aphria is trading at an 2017 EV/EBITDA multiple of 16 with long term tailwinds that will allow Aphria to grow the top and bottom line in excess of 100% for the next few years. Investors will be paying a premium for cannabis companies as the market is the fastest growing industry in North America and also because there is a scarcity of quality cannabis companies to invest in, in the public markets.

However, looking at the long-term analysis of the company, assuming a mature recreational market allows investors to pay up as they see the massive $7 – $10 billion recreational market on the horizon. Industry experts project the wholesale cannabis market to be $4 billion. Of that $4 billion, Aphria had mentioned in a press release that the 1 million square feet of growing could generate $580 per square foot. Under those assumptions, if Aphria built out the entire 1 million square feet of production capacity, Aphria would be able to produce $580 million worth of cannabis. When Aphria is able to produce that much product, they will be able to theoretically operate at full capacity and that would only equate to 14.5% of the wholesale market share ($580 million/$4 Billion). With Aphria capable of generating $580 million in revenue and EBITDA margins of 25%, it is very plausible to see Aphria capable to generating $145 million in annual EBITDA; that would equal $1.57 in EBITDA per share. With the possibility of earning $1.57 per share in EBITDA down the road, it’s no wonder you won’t be able to purchase Aphria at attractive present multiples with a company with that much earnings potential.

Risks

With all of these grandiose projections, there are some risks that could derail the long-term earnings potential of this company. One of the biggest threats to Aphria how they will fit inside of the recreational framework that will be decided upon later this year. Bill Blair, a former Toronto police chief and who is now involved in quarterbacking the legalization platform will play a major role in how the licensed producers in Canada will operate under a recreational program. Currently, the licensed producers are the only legal source for medical cannabis patients to obtain medicine from but there has been a massive influx of dispensaries popping up throughout Canada that have been dispensing medical cannabis to patients through a storefront. Aphria and the rest of the licensed producers in Canada have to ship cannabis through the mail, but the dispensaries provide patients with quick and easy access to cannabis. However, these dispensaries are operating illegally and don’t have a license to cultivate and sell cannabis. While these dispensaries have not gone through the rigorous inspections that the licensed producers have, there is no way to verify the QA/QC of the product that is being sold by these shops. The dispensaries in Canada are estimated to bring in revenue of $500 million a year, while the legal market that Aphria operates in is worth about $200 million a year right now. On Tuesday, Bill Blair praised Licensed Producers and blasted dispensaries saying that they are “reckless” and trying to make a “fast buck.” While that it is encouraging to hear, these illegal dispensaries continue to operate and hamper the already fast growing legal market to not grow as fast as it should be growing. In addition to criticizing the dispensaries, Blair endorsed the Licensed Producers and was blown away by the growing environments of the regulated licensed producers.

Another risk that could hamper Aphria’s growth is Health Canada issuing more licenses out. Currently there are 31 licenses that have been issued. While that does pose a risk to Aphria’s ability to supply 14.5% of the wholesale market share, Health Canada has been very slow at issuing new licenses. Since 2015, Health Canada has only issued 8 licenses (only 3 licenses to cultivate and sell). Health Canada has been slow to issue licenses but with recreational cannabis coming soon, they might be issuing more licenses. With more licenses, pricing could come down but being that Aphria will most likely be one of the lowest cost producers, if not the lowest cost producer, Aphria will be able to still remain highly profitable in a market where prices may come down from the average selling price of $7.50 a gram. In an environment of falling prices, Aphria’s margins may be impacted. While some industry experts believe that EBITDA margins could be 30% – 40%, for conservative measures, 25% EBITDA margins were used in my analysis.

Currently, the licensed producers are vertically integrated and don’t have storefronts, but instead ship cannabis through the mail. The current method allows for superior operating margins, as the companies don’t need to operate retail locations. With recreational cannabis framework still left to be decided, one of the most hotly debated topics is where the point of sale of cannabis will be. Pharmacies, liquor stores, and regulated dispensaries are all vying to be the supplier of cannabis. There is some speculation that the LPs themselves could open up stores themselves making themselves vertically integrated even more with retail and online ordering capabilities. In the United States, medical cannabis sells at a lower price than recreational cannabis. So, if LPs opened up their own retail outlets or wholesaled to another entity, they could still sustain most, if not the entire margin they expected to earn in the mail-only program because they could charge more for recreational sales.

Conclusion

After reading 100 Baggers by Chris Mayer, Aphria seems to have a lot of the same characteristics as many of the companies in the book that returned investors 100 times on their money. Aphria has accelerating growth, a low multiple on future earnings potential, a moat with their low production costs, heavily vested owner operators, and excellent capital allocation by the management team. Those ingredients all mixed together makes Aphria a very compelling long-term stock to buy and stick in your coffee can portfolio.