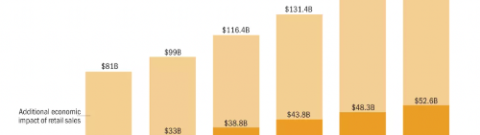

As the burgeoning Cannabis Industry continues to expand nationwide, it seems to be fostering mostly profitable businesses. Despite the myriad of regulations, legislative chaos, and continued federal government roadblocks, the majority of the businesses being started in the industry are making money. While this is not consistent across the board and many startups have failed in recent years, for the most part the industry holds tremendous opportunity for innovative and forward thinking entrepreneurs who in many cases have been successful in other industries and are now seeing the huge potential for the cannabis industry and want to be involved. Chart of the Week: Profitability in the Cannabis Industry

According to the 2016 Marijuana Business Factbook 90% of operating dispensaries and recreational marijuana stores, infused products companies and wholesale cultivators – the three pillars of the MJ trade – report that they are profitable or at least breaking even.

The cultivation and infused products/concentrates sectors are particularly lucrative, with 29% of wholesale growers and 27% of infused companies saying that they are “very profitable.” Cultivators can hit profitability fairly quickly – often after the first harvest – and many find it relatively easy to stay in the black.

When it comes to the businesses that are facilitating commerce in this fast growing industry, many startups that provide data analytics, business intelligence, B2B and C2B technology solutions and services to the marijuana industry and its customers are doing very well, with more than 40% reporting high profitability. Another area that holds great promise for entrepreneurs and investors are any technology solutions that help cannabis businesses meet with strict and complicated regulations, such as seed to sale tracking, testing, and POS compliance.

As in most industries, these types of technology firms are still finding their footing, with 26% losing some or a lot of money – the most by far of any sector. Many of these companies must shell out a lot of money to get started and face very strong competition, making the runway to profitability much longer.

The good news in this is that as more and more successful cannabis enterprises emerge, the more interest the industry will get the easier it will be to attract investment capital to fund existing businesses and newcomers which are popping up all over and have limited access to traditional funding sources. In fact recently a number of prominent celebrities have started making moves in the industry. From Willie Nelson’ Willies Reserve brand to Whoppi Goldbergs female focused MIPs, the industry sees value in celebrity backing and endorsements and it helps debunk the stigma about Cannabis.

But the real credibility and validation comes from well known tech Venture Capital superstars the likes of Peter Theil from Founders Fund fame to whispers that Silver Lake Partners, savvy and successful smart money, is headed into Cannabis. And others are beginning to sniff around and warm up to the idea that Cannabis is coming and it will be big and this is nothing about legalizing adult use recreational pot. Private wealth managers, family offices, and even some boutique investment firms are seeing it clearly. This is about a real health wellness and pharmaceutical product(s) that may very well be about to change society in ways we have yet to imagine.