Phyto Partners is a Venture Capital firm that provides debt and equity capital to privately held cannabis companies. Since June 2015, Phyto Partners has deployed capital into 30 distinct portfolio companies. Our investments stem across the value chain of the cannabis industry; because we believe ancillary businesses are critical to facilitate the growth of the industry. Our portfolio investments touch education, branded products, agriculture technology, point of sale software, biotechnology, and more.

Through our capital resources and broad network of industry relationships, we offer our companies financial sponsorship, critical strategic support, and business development assistance. Phyto Partners aims to be “more than a check”, by actively introducing our portfolio companies to potential customers, investors, and M&A targets, all while bringing our expertise to the table.

Our portfolio companies are able to leverage off one another and collaborate to execute successful business plans. Our advisors and industry relationships bring together the knowledge and expertise to help our portfolio companies thrive in the dynamic and fast growing cannabis industry.

Investment Criteria

- Experienced management team

- Clear value proposition

- Defensible market, customer and product positions

- Intellectual property

- Visibility to profitable cash flows

- Synergy with our portfolio companies

- Strategic capital co-investors

- 6-9 months monitoring of management/operations and execution

- Justifiable valuation

Areas of Focus

- Advertising Technology

- Agriculture Technology

- Biotechnology (Genetics and Biosynthesis)

- Brand Building (Consumer Packaged Goods)

- Cannabis Delivery Services

- Data

- Education

- Hemp/CBD

- Intellectual property around product bioavailability and onset/offset time

- Medical Dosing Technology

- Software (SaaS)

Our strategy is to invest in ancillary companies that provide business critical solutions to the licensed operators, those that enable the licensed producers to COMPLY with laws, MANAGE the business, CONNECT with customers, BUILD brands, REDUCE costs, and operate more efficiently in this highly regulated industry

In the cannabis supply chain, we see the most value in product/brand development. Innovation will be a key differentiator for growing and building brands. We see other areas of the value chain being more commoditized over time. Given the newness of the legal cannabis industry, every part of the value chain will drive value in the near-term.

There is substantial pressure upon the cannabis industry to respond to legal regulations, which can be complicated, time consuming, and expensive. We look for companies that can profit because of this regulatory and compliance chaos.

Significant opportunities exist to invest in cannabis industry operations requiring the engagement of neutral third parties to ensure accurate, timely, and competent compliance with various state and federal regulatory authorities. Technology solutions and data analytics will be a critical infrastructure backbone and will provide significant opportunities for exponential growth opportunities

How Big is the Opportunity?

The total addressable market for cannabis continues to grow with new jurisdictions being unlocked at a rapid pace. Around 90% of the states in the US have some sort of medical cannabis program in place and an increasing number are becoming recreational, which allows for common use amongst adults that are 21 or older.

As a business opportunity, cannabis legalization is spawning a gold rush creating an entire industry from legal growing operations to secondary and tertiary businesses to support the conversion of this industry from illegal to legal.

As cannabis operations are captive to each state, the economic multiplier impact in those states is 3-4x revenue.

In 2018, the Cannabis industry generated ~$11 billion in sales and created nearly 250,000 new jobs. In 2019, total U.S Cannabis sales amounted to $12 billion and had an economic impact of $43 billion

By 2025, industry employment is expected to be ~ 560K people, or the equivalent of the population of Atlanta or Milwaukee.

We expect the number of people employed to reach near 1 million by 2030, as more states open up and continue to grow the usage rates and revenue per person.

Catalysts and Industry Movement

Despite whom wins the Senate or Presidency, catalysts and tailwinds are widespread for the industry and we continue to see legalization measures move forward one state at a time.

There are 66 bills with some aspect of cannabis reform in Congress; the three mostly likely to be put before a conference committee and voted on are the SAFE Banking Act, STATES Act, and MORE Act.

SAFE Banking Act (Primary Focus: Banking access and payment processing – narrow in scope and would not materially alter the industry).

STATES Act (Primary Focus: Defers to state law – codifies the existing state regulated system with carve out state-level exceptions to the Controlled Substances Act of 1970 (CSA) rather than de-schedule cannabis at the federal level)

MORE Act (Primary Focus: Nationwide de-scheduling – most comprehensive legislation, but potentially the hardest to pass).

Two of the main arguments generally brought up when discussing legalization are 1) the impact on teen usage, and 2) the effect on impaired driving / accidents.

1) Teen cannabis use in CO and WA has declined or held flat following adult-use legalization.

2) While the number of car crashes has increased to a degree post adult-use legalization, crash fatalities have not.

Multi State Operators are beginning to display extremely fundamentally strong business models, which is very unusual for such an early stage industry.

These business have exponential growth rates compared to other consumer industries.

Best-in-class operators have sales per foot around that of Apple’s U.S. retail locations. Average cannabis retail locations have retail productivity close to that of Tiffany or Lululemon – ~$3-3.5k sales per sq ft.

Profit rates (measured by gross margin today) are also best-in class. As this industry is more vertically integrated due to regulatory requirements or due to lack of product availability, gross margin rates are among the highest for consumer companies. EBITDA rates between 40-50% are not uncommon among more established cannabis companies, and we’d expect gross margin rates for scaled operators to be in the 30-40% range at steady-state.

A challenge of operating a cannabis business in the U.S. is that they pay an exorbitant amount in federal taxes, are heavily regulated at the state level, have limited protections under federal law, have no access to the U.S. capital markets, and can’t even have a checking account at a federally chartered bank. They are forced to operate in a sub-scale manner because it is a violation of federal law.

It is only a matter of time until this changes…

Source: Needham Report 2020

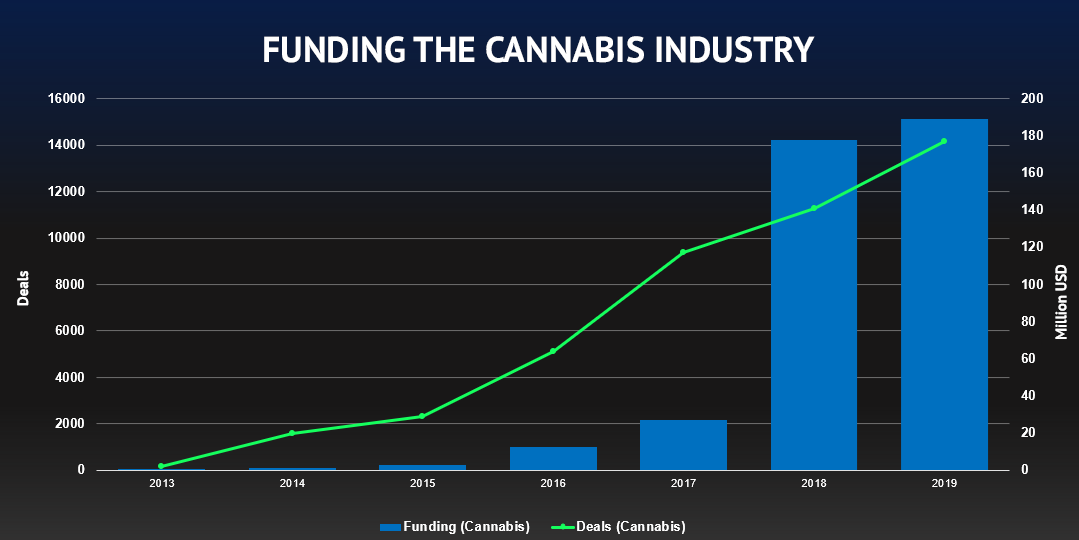

Investment Capital

Private capital is seeking out opportunities in the Cannabis industry at a break neck pace. Cannabis-related companies raised over $13.8 billion in 2018, compared to $3.5 billion in 2017. Private investments specifically grew from $591 million in 2017 to $4 billion in 2018, according to Viridian Capital Advisors.