We are honored to be acknowledged as one of the most active VC investors in the cannabis space. Phyto Partners will continue to invest in skilled, talented, and passionate entrepreneurs that will build strong companies that become industry leaders. It was our decision to invest in companies that provide a service(s) or make a product that enables the industry to grow and expand and provide the industry the critical methods and infrastructure that will help the market function and comply with all laws and regulations. At the core of our newest fund that we launched we remain committed to the same investment thesis that has provided attractive returns to our investors. The goal in fund 2 is the same; to generate superior returns by making many smart decisions that will produce a portfolio with high returns and lower risk.

The top 12 venture-capital firms making deals in the booming cannabis industry that’s set to skyrocket to $75bil

Jeremy Berke October 11, 2018 Business Insider

Ever since Colorado legalized cannabis for all adults in 2014, the cannabis industry has blossomed, with a multitude of companies competing to scale up as more states legalize the drug. With so few institutional investors ready to write checks to cannabis companies — marijuana is still considered a Schedule I drug by the US federal government — the industry has given rise to a number of sector-specific firms that deeply understand the nuances of investing in such a highly regulated and fragmented market.

Besides Lerer Hippeau and Slow Ventures, these cannabis specific funds mostly raise money from private investors or family offices that may have a higher risk appetite than the average pension fund. They get into top startups before the bigger players begin throwing their weight around, and can quickly adapt to shifting regulations and consumer sentiment.

In the US, most funds focus on ancillary companies, which are startups that provide software and services to the cannabis industry, or biotech firms focused on the agricultural or pharmaceutical side of the industry, rather than investing directly in companies that touch the plant itself. It’s a method for skirting federal marijuana regulations, though some funds will invest directly in plant-touching businesses.

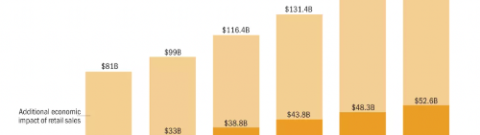

But now that Canada’s set to legalize marijuana this month, more capital is rushing into the market than ever before. Because the country has federally coherent regulations, some of Canada’s biggest banks have pushed into space, either underwriting deals or helping cannabis startups go public. Last year the total value of all venture deals in the cannabis space across the globe was just under $378 million, according to analytics firm PitchBook.

By the beginning of October, that number nearly doubled, to $643 million. To put that growth in perspective, in 2012, the first year PitchBook had data available, there were only two deals in the cannabis sector — worth just $300,000. According to some estimates, cannabis may become a $75 billion industry in the next few years. To get a handle on who’s cutting early-stage deals in the fledgling industry, Business Insider pulled data from PitchBook and reached out to the top venture-capital firms in the industry. (New deals are happening all the time, so we’ll keep updating as we learn more.)

Here are the top venture-capital firms in the cannabis industry:

Phyto Partners focuses on the ancillary side of the booming US cannabis industry.

Larry Schnurmacher, Managing Partner

Location: Boca Raton, Florida

Deal Count: 16

Based in Florida, Phyto Partners has made 16 deals in the cannabis sector since the firm formed in 2015. It focuses on ancillary companies that provide software and services to the cannabis industry but don’t touch the marijuana plant itself, Brett Finkelstein, the firm’s managing director said. “Not a lot of institutional or strategic capital was available to founders when we launched,” Finkelstein said. “We wanted to get in early so we can have the most positive impact on companies we invest in.

“Phyto’s portfolio includes companies like Colorado-based Wurk, a payroll-management company for the cannabis industry, and Vangst, a recruiting firm focused on cannabis companies. “If you strip away the hype around the cannabis industry, it’s really no different from other more established sectors or business models,” Finkelstein said. “In order to be successful, companies must have great leadership, produce a quality product, at a competitive price and sell/distribute as efficiently as possible.”

Karan Wadhera of Casa Verde Capital. Courtesy of Casa Verde Capital

Location: Los Angeles

Deal Count: 15

Los Angeles-based Casa Verde Capital has made 15 venture investments in the cannabis industry, according to Karan Wadhera, the firm’s managing partner. It was founded in 2015 by a team that includes the rapper Snoop Dogg, but it really started building out its portfolio in the summer of 2016, Wadhera said.

Like other US-based firms, Casa Verde invests in ancillary businesses, including Dutchie, an online-ordering platform, and Eaze, a cannabis-delivery company.

“The ancillary space presents some of the most compelling investment opportunities,” Wadhera told Business Insider. “These businesses are especially exciting as they can scale the quickest with the smallest amount of capital.”

In June, Casa Verde participated in a Series A funding round into Oxford Cannabinoid Technologies, a biotech startup researching cannabinoid medicines, along with the venture arm of the tobacco company Imperial Brands.

Altitude Investment Management is a New York City-based firm that’s raised $25 million.

Location: New York

Deal Count: 15

The New York City-based Altitude Investment Management has made 15 deals since the firm’s launch in 2017, according to Jon Trauben, a partner in the firm.

Altitude invests in both ancillary and plant-touching companies, with a focus on data and analytics.

“Data and clarity in the cannabis market is lacking, so having a strong network to tap into is essential,” Trauben told Business Insider. “We think it’s critical to invest in the industry on a portfolio basis to diversify exposure and manage known and unknown risks.”

Altitude’s portfolio consists of startups across a range of verticals, such as PathogenDx, a DNA-testing firm geared toward cannabis; Flowhub, a point-of-sale-software service for dispensaries; and Green Flower, a digital-media outlet.

Merida Capital is a New York City-based fund that invests in later-stage startups.

Mitch Baruchowitz Managing Partner

Location: New York

Deal count: 40

New York City-based Merida Capital has made 40 investments in 22 cannabis companies, Mitch Baruchowitz, a managing partner, told Business Insider. Baruchowitz, a former corporate lawyer, founded Merida in 2016 after being involved in the cannabis industry since 2010. Unlike other firms on this list, Merida mostly invests in later-stage companies, rather than in seed rounds.

Baruchowitz believes two of the hottest areas to invest in the cannabis sector are agricultural technology and data analytics. To that end, Merida has teamed up with private-equity fund Pegasus Capital to invest in Vividgro, a state-of-the-art lighting and growing system for indoor greenhouses. Baruchowitz said data is going to be the “most disruptive” evolution of the cannabis market.

“When data becomes actionable, when the data sets become big enough, it’s going to be like whiplash for the market,” Baruchowitz said. “When data moves into the space, all of that historical or even instinctual behavior goes away.” Merida has made multiple investments in New Frontier Data, a cannabis-industry analytics firm, along with compliance platform Simplifya, among other investments.

Illinois-based Salveo Capital has made 15 investments in nine portfolio companies, from payroll processing to DNA testing.

Michael Gruber and Jeff Howard. Courtesy of Salveo Capital

Location: Northbrook, Illinois

Deal Count: 14

Illinois-based Salveo Capital has signed 14 deals in nine portfolio companies in the cannabis industry since the firm was founded in 2016, according to Jeff Howard and Michael Gruber, Salveo’s managing partners.

Salveo’s portfolio includes ancillary startups like payroll firm Wurk and dispensary customer-relations platform Baker. It also invests in biotech startups like PathogenDx and Front Range Biosciences. The partners said that in the run-up to full-scale legalization in Canada, the “floodgates of capital” have opened.

“VC’s need to be nimble and quick enough to execute in a generally oversubscribed fundraising condition before valuations increase,” they said.

Lerer Hippeau Ventures is one of the few mainstream VC funds to write checks in the cannabis sector.

Eric Hippeau, Managing Partner

Location: New York

Deal Count: 4

Lerer Hippeau is one of the few mainstream venture-capital firms to invest in the cannabis industry. To date, the New York City-based fund — perhaps most well-known for its high-profile investments in digital-media companies like BuzzFeed and Axios and the shoe brand Allbirds — has invested in four cannabis companies.

“We started paying attention when Colorado became the largest state to fully legalized cannabis,” Eric Hippeau, one of the firm’s managing partners, told Business Insider in an email. “We see the opportunity in investing in basic blocks establishing the infrastructure of the industry,” Hippeau said.

So far, the firm has invested only in ancillary companies, like Leaflink, a software platform for dispensaries; Herb, a digital-media company; and recruitment platform Vangst. “Until cannabis is legalized at the federal level, we have decided not to invest in the product itself, with the exception of CBD products,” Hippeau said.

Green Acre Capital launched a $25 million cannabis-specific fund

Matt Shalhoub, Managing Partner

Location: Toronto, Ontario

Deal Count: 13

Toronto-based Green Acre Capital has made 13 investments in its $25 million Fund I, which is dedicated to cannabis. The firm just closed its Fund II at $75 million and is starting to make investments, Matt Shalhoub, Green Acre’s managing director, told Business Insider.

Since the firm is in Canada, where marijuana is federally legal, the fund is free to invest in plant-touching startups like edible brands, cannabis retail stores, as well as hemp and CBD-infused products, Shalhoub said.

The firm had successful exits in Tokyo Smoke, a retail brand that was acquired by Canopy Growth, and Anandia Labs, a cannabis-testing firm that was acquired by Aurora.

“There has been a lot of volatility in the space, and people definitely need to have the stomach for large swings in either direction,” Shalhoub said.

Tuatara Capital focuses on building consumer-facing brands and investing in cannabis biotech companies

Tuatara partners Al Foreman, Mark Zitman, and Marc Riiska.

Location: New York

Deal Count: 8

Tuatara Capital has made eight portfolio investments in the cannabis industry as of the end of September, according to Al Foreman, Tuatara’s chief investment officer and a former JP Morgan investment banker.

The firm signed its first deal in 2015 and has made additional investments in a number of its portfolio companies, from consumer-facing brands like Willie’s Reserve to biotech companies like Teewinot Life Sciences, which is developing patents for the production of cannabinoids from marijuana for pharmaceutical applications.

“We see the biggest opportunities in the industry as our ability to build and scale national and global cannabis brands, and also the opportunity to finance innovative companies and technologies that will ultimately impact the cannabinoid pharmaceutical and nutraceutical end-markets,” Foreman told Business Insider.

Poseidon Asset Management is run by a brother-and-sister team out of San Francisco.

Morgan and Emily Paxhia, Managing PArtners

Location: San Francisco

Deal Count: 47

Founded by brother-and-sister team Morgan and Emily Paxhia in 2013, San Francisco-based Poseidon Asset Management has rapidly scaled up to become a leading player in the cannabis industry.

Not counting the firm’s public market trading activity, Poseidon has made 47 venture investments in 35 portfolio companies with over $80 million deployed, Morgan Paxhia, the firm’s cofounder and managing partner, told Business Insider.

Like some of his peers, Paxhia said he’s “very bullish” on the ancillary sector of the industry. “This is a broad category, as this can range from consumer devices to enterprise SaaS solutions,” Paxhia said. “We see great return opportunities as VCs in this vertical.”

Paxhia was quick to note that the fragmented nature and swiftly changing regulations of the cannabis industry make it challenging to run a fund. “Yes, this industry is moving very quickly, but managing outside capital carries a lot of responsibility for the betterment of your investors and the legitimacy of the industry,” Paxhia said.

Slow Ventures was founded by a group of former Facebook employees and has invested in a few California-based cannabis startups.

Kevin Colleran, managing director

Location: San Francisco

Deal Count: 8

Like Lerer Hippeau, San Francisco-based Slow Ventures — which was founded by a group of former Facebook employees — is one of the few mainstream early-stage venture-capital funds to invest directly in the cannabis industry.

According to its website, Slow Ventures has, for example, put money into Eaze, a San Francisco-based cannabis-delivery service; Meadow, a delivery and point-of-sale system for California dispensaries; and Bloom Farms, a vaporizer company. Beyond cannabis, Slow Ventures has made successful exits in Blue Bottle Coffee and home-automation company Nest, along with investments in the mattress startup Casper, Postmates, and Pinterest.

Arizona-based Hypur Ventures has made eight ancillary cannabis-industry investments since launching in 2017.

Tahira Rehmatullah is a managing director at Hypur Ventures

Location: Scottsdale, Arizona

Deal Count: 9

The founders of Arizona-based Hypur Ventures first started looking at the cannabis industry in 2014, and the firm officially launched in 2017. So far, Hypur has signed eight deals, according to Tahira Rehmatullah, a managing director at the firm.

Rehmatullah told Business Insider Hypur is “vertical agnostic” when it comes to deciding which companies to invest in. Rehmatullah said there are numerous opportunities across the cannabis industry for investors, including industrial hemp, software and tech firms, and CBD-infused products.

Hypur’s portfolio companies include the data-analytics firm Headset, the compliance platform Simplifya, and online content platform Dope Media.

The Arcview Group is a network of high-net-worth investors who have put more than $200 million in 190 cannabis companies.

Arcview Group CEO Troy Dayton

Location: San Francisco

Deal Count: 190

The Arcview Group is a cannabis-industry heavyweight. While the company has multiple lines of business, including industry research, it organizes an investor network of high-net-worth people who have placed $200 million into a portfolio of 190 companies, according to David Abernathy, a vice president at Arcview.

On top of the investor network, Arcview manages special-purpose vehicles (SPVs) that pool capital from accredited investors. Through these SPVs, Arcview has made 26 investments in 16 companies, Abernathy said.

Arcview recently launched a more traditional managed fund, though it hasn’t made any investments yet. As with other US-based investors, Arcview is bullish on ancillary startups.

“There are some great potential investments in plant-touching businesses, especially emerging brands, but many of the businesses with the most growth potential are in various ancillary product and services categories,” Abernathy said.