By Natan Ponieman , Benzinga Staff Writer

PitchBook, a financial database and information platform on private equity, has released its list of the top venture capital firms investing in cannabis in 2019.

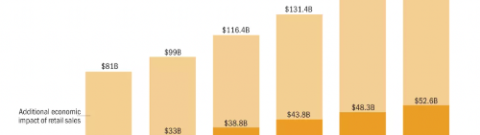

Last year set a $1.2-billion record for venture capital investments in cannabis.

That amount has already been surpassed by $500 million in 2019, according to PitchBook, with more than 40% of investments going to California startups.

Phyto Partners Tops The List

Florida-based Phyto Partners has become this year’s biggest dealmaker in the VC landscape, having struck a total of nine deals in 2019 alone.

Phyto has almost double the number of deals closed by the next two firms on the list: Arcadian Fund and Gotham Green Partners have closed five deals each so far this year.

Cannabis spoke with Larry Schnurmacher, Phyto’s managing partner, about the firm’s investments in the space.

The company has been sourcing cannabis opportunities since 2014 and has developed a pipeline of investment targets, he said.

“As these companies prove their product, service or business model, we are ready to act. In addition, our industry intel and experience helps to streamline our due diligence process, which allows us to be able to act quickly and take advantage of new opportunities in real time.”

AFI Capital Partners, Big Rock, Cresco Capital Partners and Poseidon Asset Management, all of which have closed four VC investment deals on this year so far.

Benzinga’s Cannabis Capital Conference heads to Detroit on Aug. 15 — click here to learn more!

VC Deals Grow In Size

PitchBook’s analysis also included 2019’s largest VC investments to date.

The largest-ever deal for a VC-backed company in U.S. legal cannabis history comes from Pax Labs, which closed a $420-million equity round earlier this year.

Surterra Wellness raised $265 million in two separate rounds.

“The accelerating activity we are seeing in the cannabis space, in both number of deals and deal sizes, is a direct result of the industry’s growth and future prospects,” said Phyto’s Schnurmacher.

“More and more family offices, traditional venture capital funds and high net worth individuals are starting to join the fray, especially in deals that don’t touch the plant and are not violating federal law.”

Federal law continues to be the largest roadblock to the flow of investment dollars into cannabis.

The development of further legislation, like the approval of the SAFE Banking Act, could soon change this situation and allow for even greater possibilities for cannabis businesses and ancillary markets.